With high proficiency in innovative technologies and …

Due to aerospace suppliers’ increasing focus on efficiency and cost reduction as they endeavor to meet ramp-ups on existing platforms, companies offering solutions to accelerate timelines and meet these targets are in strong demand. Therefore, whilst many players in the industry are experiencing slower demand due to fewer new aircraft sales, the engineering services segment has seen a great deal of growth. “OEMs need to increase their speed of production as the book of orders keeps growing,” commented Fernando Ledesma, corporate director at AKKA Technologies, an engineering and technology consulting company.

As well as increasing efficiency on existing projects, companies must also adopt more innovative processes in order to be competitive globally and win new contracts. Small companies offering specialized solutions are in high demand, sought out due to proof of fast and tangible results. “There are now more service providers and competitors as it is easier for startups and overseas companies to penetrate the North American market,” said John Mannarino, president at Mannarino Systems & Software. “We have seen more cost pressure from South American and Asian companies, which did not exist before. However, while globalization and lower-cost offshore rates are in demand, the complexity and cost of running OEMs are quite high. We are trying to take advantage of this and offer our expertise in combination with the advantages of higher efficiency and leaner services offered by an SME to win bigger contracts.”

Mannarino aims to offer complete turn-key packages, developing complete embedded software packages including certification. The company is the only service-based organization in Canada that is authorized as a Design Approval Organization (DAO) for airborne software and airborne electronic hardware. In recognition of the SME’s promise, Lockheed Martin recently invested in Mannarino to facilitate the development of its own proprietary airborne software products. The investment also marks the largest ever made by Lockheed Martin into a Canadian SME.

Whilst many companies want to increase efficiency, implementation of the relevant technologies can sometimes be a challenge. “Advanced manufacturing techniques are gaining ground in the aerospace industry to help meet this challenge,” continued Ledesma. “AKKA is working with some aerospace companies to bring the lean manufacturing techniques and the automated processes of the automotive industry into the building of planes.”

Echoing the need to address implementation challenges, John Nassr, president at ICAM Technologies noted: “The number one challenge companies have in manufacturing is finding affordable engineers with programming skills. Our service targets this need and helps companies cut down on programming and machining time, so that they get parts cheaper, better and faster. There are not many companies like ICAM that are able to bridge the gap between the world of automation, aerospace programming and CNC machines. Our employees have a high level of knowledge of CNC programming, CATIA and SIEMENS systems, CNC machine milling and software. We also provide consultations at customers’ facilities and offer them solutions based on the technology available. Customized solutions are the key to offering automation to aerospace.”

Alongside customization, scalability is also a key consideration as smaller companies are often unable to make the necessary investments to overhaul their processes. ICAM is now expanding internationally through an established network of resellers.

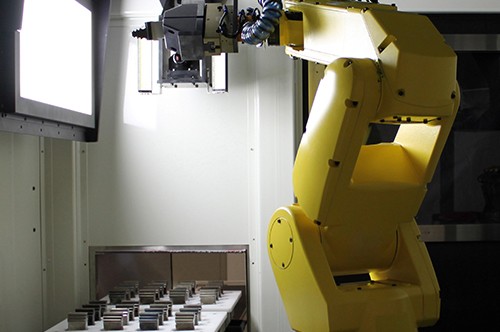

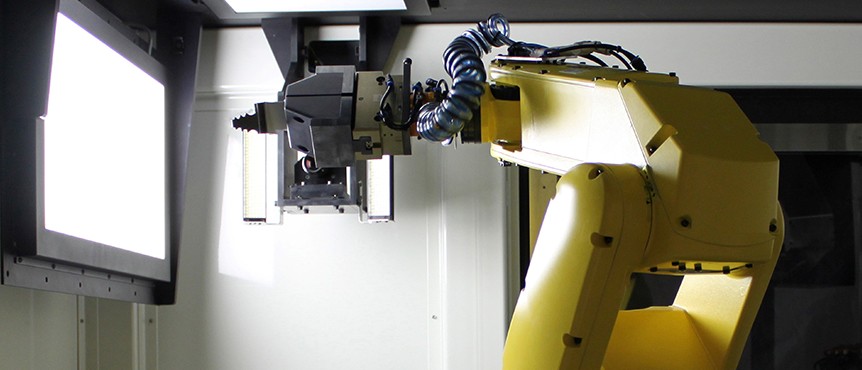

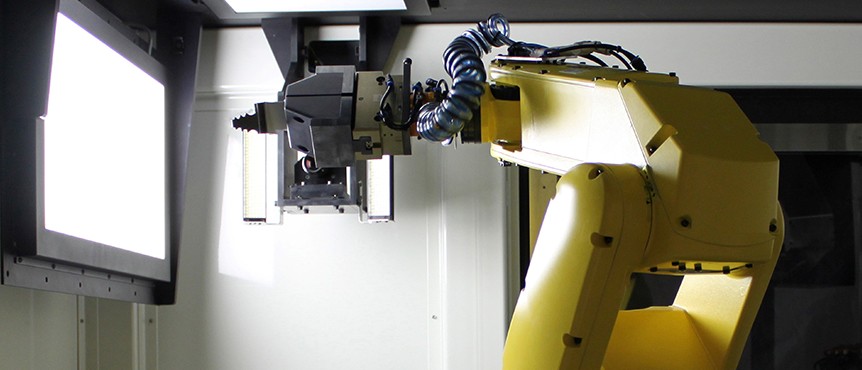

Equally, companies look to equipment that offers a quick return on investment through increased efficiency and reduction of costs. As equipment generally represents a non-recurring cost, companies are keen to invest in machinery with a quick return on investment (ROI). “With regard to our tooling services, we see a strong demand for high-precision, tight-tolerance parts and components,” noted Luis M. Aguilar, business development manager at Avitec Tools. “There is also a big push for more automation projects that require complex tooling solutions involving robots or other forms of automation. Because tooling equipment is a non-recurring cost, price pressures are not as pronounced as for production parts for example, where cost reduction initiatives must be incorporated into any program, although there is always competition.”

Avitec’s main business consists of special cutting tools and ground support equipment services as well as high-precision, tight-tolerance, machined parts and components. “With regard to special cutting tools, the most significant changes in demand have been for high quality carbide and Poly-Crystalline Diamond (PCD) tools, which improve the durability of tools,” added Aguilar. “Responding to these changing needs, Avitec leverages its decades of experience to work on designing new tools using PCD’s. One of our main areas of R&D focus at present is on new technologies for supporting PCDs.”

Avitec is now focused on developing new markets and expanding its base into the rest of Canada, the United States and Mexico.

With high proficiency in innovative technologies and processes, Québec’s service companies and equipment providers are well-placed to deliver cost-effective solutions to drive the aerospace sector’s competitiveness.

Due to aerospace suppliers’ increasing focus on efficiency and cost reduction as they endeavor to meet ramp-ups on existing platforms, companies offering solutions to accelerate timelines and meet these targets are in strong demand. Therefore, whilst many players in the industry are experiencing slower demand due to fewer new aircraft sales, the engineering services segment has seen a great deal of growth. “OEMs need to increase their speed of production as the book of orders keeps growing,” commented Fernando Ledesma, corporate director at AKKA Technologies, an engineering and technology consulting company.

As well as increasing efficiency on existing projects, companies must also adopt more innovative processes in order to be competitive globally and win new contracts. Small companies offering specialized solutions are in high demand, sought out due to proof of fast and tangible results. “There are now more service providers and competitors as it is easier for startups and overseas companies to penetrate the North American market,” said John Mannarino, president at Mannarino Systems & Software. “We have seen more cost pressure from South American and Asian companies, which did not exist before. However, while globalization and lower-cost offshore rates are in demand, the complexity and cost of running OEMs are quite high. We are trying to take advantage of this and offer our expertise in combination with the advantages of higher efficiency and leaner services offered by an SME to win bigger contracts.”

Mannarino aims to offer complete turn-key packages, developing complete embedded software packages including certification. The company is the only service-based organization in Canada that is authorized as a Design Approval Organization (DAO) for airborne software and airborne electronic hardware. In recognition of the SME’s promise, Lockheed Martin recently invested in Mannarino to facilitate the development of its own proprietary airborne software products. The investment also marks the largest ever made by Lockheed Martin into a Canadian SME.

Whilst many companies want to increase efficiency, implementation of the relevant technologies can sometimes be a challenge. “Advanced manufacturing techniques are gaining ground in the aerospace industry to help meet this challenge,” continued Ledesma. “AKKA is working with some aerospace companies to bring the lean manufacturing techniques and the automated processes of the automotive industry into the building of planes.”

Echoing the need to address implementation challenges, John Nassr, president at ICAM Technologies noted: “The number one challenge companies have in manufacturing is finding affordable engineers with programming skills. Our service targets this need and helps companies cut down on programming and machining time, so that they get parts cheaper, better and faster. There are not many companies like ICAM that are able to bridge the gap between the world of automation, aerospace programming and CNC machines. Our employees have a high level of knowledge of CNC programming, CATIA and SIEMENS systems, CNC machine milling and software. We also provide consultations at customers’ facilities and offer them solutions based on the technology available. Customized solutions are the key to offering automation to aerospace.”

Alongside customization, scalability is also a key consideration as smaller companies are often unable to make the necessary investments to overhaul their processes. ICAM is now expanding internationally through an established network of resellers.

Equally, companies look to equipment that offers a quick return on investment through increased efficiency and reduction of costs. As equipment generally represents a non-recurring cost, companies are keen to invest in machinery with a quick return on investment (ROI). “With regard to our tooling services, we see a strong demand for high-precision, tight-tolerance parts and components,” noted Luis M. Aguilar, business development manager at Avitec Tools. “There is also a big push for more automation projects that require complex tooling solutions involving robots or other forms of automation. Because tooling equipment is a non-recurring cost, price pressures are not as pronounced as for production parts for example, where cost reduction initiatives must be incorporated into any program, although there is always competition.”

Avitec’s main business consists of special cutting tools and ground support equipment services as well as high-precision, tight-tolerance, machined parts and components. “With regard to special cutting tools, the most significant changes in demand have been for high quality carbide and Poly-Crystalline Diamond (PCD) tools, which improve the durability of tools,” added Aguilar. “Responding to these changing needs, Avitec leverages its decades of experience to work on designing new tools using PCD’s. One of our main areas of R&D focus at present is on new technologies for supporting PCDs.”

Avitec is now focused on developing new markets and expanding its base into the rest of Canada, the United States and Mexico.

With high proficiency in innovative technologies and processes, Québec’s service companies and equipment providers are well-placed to deliver cost-effective solutions to drive the aerospace sector’s competitiveness.