FILTER

FILTERED INTERVIEW RESULTS

André Passos Cordeiro

PRESIDENT, THE BRAZILIAN CHEMICAL INDUSTRY ASSOCIATION (ABIQUIM)

"It is urgent to create policies that guarantee the competitiveness and resumption of growth in the Brazilian industrial chemical sector, which is vital for society and has great production potential."

Álvaro Pérez

PRESIDENT, VOPAK BRAZIL

"In Latin America, there is significant potential for green ammonia and hydrogen projects, however, the full-scale development of these will depend on market demand."

Louis-Pierre Gignac

CEO, G MINING VENTURES

"The state of Pará is emerging as a hub for Canadian mining companies."

Paul Brink

PRESIDENT AND CEO, FRANCO-NEVADA CORPORATION

"In the current gold price environment, when operators have the capital to spend on putting new mines into production and expanding existing mines, there is tremendous organic growth."

Eduardo Orban

CEO, MINERAÇÃO TABOCA

"Mineração Taboca is one of the few companies in the global tin market that owns its own mine, the Pitinga mine, located in the Amazon Region, which is one of the richest tin and tantalum mines in the world."

Carlos De Lion Neto

SOUTHERN CONE PRESIDENT, ARKEMA

"As the scale of sustainable products increases, it becomes easier to introduce these materials into both mature markets and developing markets."

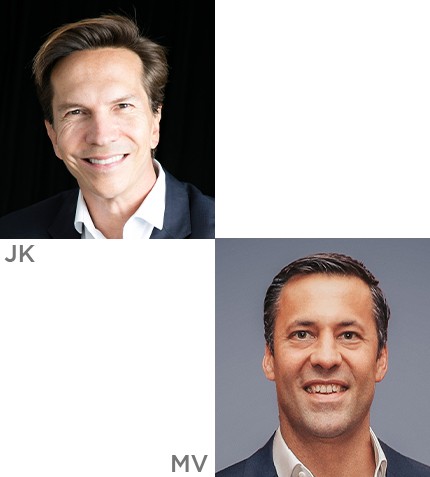

Jan Krueder and Matthias Vorbeck

JK: CEO, QUÍMICA ANASTACIO AND MV: GENERAL DIRECTOR, ANASTACIO OVERSEAS

"Our leadership in Brazilian distribution demands competitive pricing strategies, robust sourcing capabilities and negotiating locally for efficient logistic solutions."

Carla Wilson

GENERAL MANAGER, BHP BRASIL

"Our top priority in Brazil remains ensuring the full and fair reparation of those affected by the Samarco dam failure."

Ana Sanches

CEO, ANGLO AMERICAN BRASIL

"Mining is one of the Brazilian economy's three main sectors and one with the greatest potential for growth in the next decade."

Paulo Misk

COO, LITHIUM IONIC

"The unique geological conditions in the Jequitinhonha Valley favor spodumene crystallization, making it one of the best areas globally for lithium extraction."