A Middle Eastern El Dorado

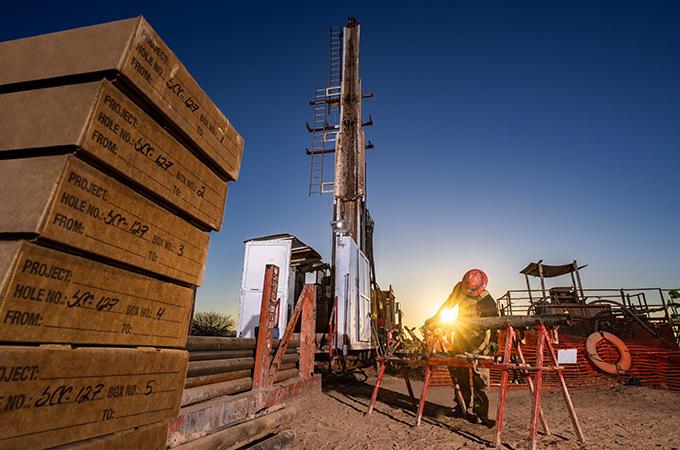

Image courtesy of Ivanhoe Electric

The Arabian-Nubian Shield has been shaped over 300 million years into a treasure trove of mineral wealth. Split by the Red Sea between the Arabian Peninsula and including parts of Egypt, Sudan, Eritrea and Ethiopia in north-east Africa, the Shield boasts an ancient, intricate polymetallic geology. In Saudi Arabia, beneath the surface across hundreds of thousands of square kilometers, lie in excess of US$2.5 trillion worth of the enormous geological complex’s mineral reserves. Much of that vast expanse of opportunity remains un- or underexplored, with potentially considerable minerals deposits concealed beneath sedimentary cover or within complicated tectonic zones.

It is this wealth of possibility that is a central driving force in the Kingdom’s emergence as one of the world’s fastest-growing mining markets. Between 2020 and 2024, exploration spending in Saudi Arabia quintupled, climbing from US$55 million to over US$280.5 million. “Exploration is currently the industry’s primary focus, positioning Saudi Arabia as a highly attractive destination. I would call it the ‘star’ of global mining,” lauded Yasir Hamid, division manager of mining and infrastructure solutions at Saudi equipment distributor Bin Shehab.

The diversity in Saudi Arabia’s mineral resources are part of what sets it apart as an exploration frontier. “Saudi Arabia is truly blessed with an abundance of mineral resources, including critical minerals and rare earth elements. Companies and investors are now focusing on minerals such as lithium, graphite, and rare earths in addition to the traditional gold, copper, and zinc,” explained Abdullah Al-Attas, general manager of service provider Geotech Arabia, also pursuing its own exploration projects.

Industry insiders are optimistic that this potential will soon bear fruit. “Much of Saudi Arabia’s highly prospective ground is already licensed and I am confident that major discoveries will be made across the Arabian Shield in future years,” said Antony Benham, regional director for the UK and Saudi Arabia at global mining consultancy MSA.

Untapped potential

One of the sector’s most important players in the Kingdom today is Arizona-based Ivanhoe Electric. “Our technology-driven platform targets some of the most prospective terrain globally, leveraging advanced tools and skilled personnel to generate discoveries that benefit both the Kingdom’s mining industry and our shareholders,” outlined Taylor Melvin, president and CEO.

In September 2025, Ivanhoe’s land package under exploration in a 50:50 joint venture with Maaden was expanded to over 50,000 km2. The vast scale on offer, as illustrated by Ivanhoe’s exploration footprint, is attracting international explorers to the Kingdom. “Activity on the Shield is accelerating, with major players exploring and early successes boosting the entire market,” observed Brock Salier, CEO of Almasar Minerals, which was awarded licenses in the ninth round of Saudi Arabia’s competitive auctions for exploration companies.

Another factor is the Kingdom’s predominantly greenfield status. “Saudi Arabia remains largely untapped, particularly for gold exploration, which is where we are focusing our effort. Early successes here could open doors to additional projects and partnerships,” said Graham Carman, CEO of Canada-headquartered junior Tinka Resources, which is exploring the Huwaymidan gold project in Saudi Arabia, in addition to its flagship Ayawilca project in Peru.

Geotechnical experts are optimistic about Saudi Arabia’s deeper geological formations too. “Areas under sedimentary cover and complex tectonic environments hold the potential for tier-one deposits,” suggested Teo Hage, VP technology for Xcalibur Smart Mapping, which is responsible for a 600,000 km2 regional geophysical mapping program across the Shield.

Modern technologies enable explorers to model deposits at depths of 500 m or deeper, with the Shield’s sparse surface exposure offering relatively simple ground setup and clean data. Of course, prospectivity is one thing, and results are another. While there is strong optimism, with the true potential only to become clear once drilling results are compiled.

At this still-early stage of Saudi Arabia’s mining development, those results will be a catalyst to help juniors, relying almost entirely on external capital, to generate investor interest. Mohammed Al-Mutairi, country manager at junior Saudi Discovery Co., reflected on current investor sentiments within the Kingdom: “Local investment remains challenging, because exploration is still a relatively new field for many Saudi investors. It takes time to build awareness of how this industry works and how value is generated over the long term.”

Opportunity in the intangibles

Saudi Arabia’s immense prospectivity is just one of many considerations juniors take when choosing one jurisdiction or another. Auxiliary factors, from funding environments to political culture, can influence explorers’ choices and appetite for risk. Those on the ground say the Kingdom is performing well. “Strong government support, good infrastructure, excellent local collaboration and a rapidly transforming cultural framework make for a positive and promising environment,” confirmed Tinka Resources’ Carman.

“The Kingdom’s updated mining regulations were a decisive factor in our entry, offering transparency, structure, and strong support for junior exploration companies,” verified Mohamed Elhebery, CEO and exploration manager for Batin Al-Ard, an Egyptian-Saudi joint venture gold and critical mineral explorer established in 2023.

Part of that support is a package of substantial financial incentives. Via its Exploration Enablement Program (EEP), the Saudi government is investing SAR 685 million (~US$182 million), offering funding of up to SAR 7.5 million (~US$2 million) per license to help cover early-stage exploration activity. Terry Lynch, CEO of Québec-based junior Power Metallic, exploring its Jabal Baudan concession in the Kingdom, applauded the program’s level of assistance: “Saudi Arabia’s exploration support program is one of the strongest globally. This forward-looking initiative helps de-risk early-stage exploration.”

Another factor marking out the Kingdom from many global peers is its stability. Saudi Arabia ranked in first place globally for political stability in the Fraser Institute’s 2024 survey; such are the benefits of absolute monarchy. This also applies to the security of on-the-ground operations. “Unlike elsewhere, where tenders often include armed guards and bulletproof vehicles, whereas in Saudi Arabia such measures are unnecessary. Local communities are welcoming, hospitable, and supportive,” explained Steve Little, CEO of market entry consultancy Massar Business Solutions.

Juniors also praise the Saudi government’s facilitation of rapid and agile activity. While in many other jurisdictions a common complaint from explorers is the time spent waiting for permits, in Saudi Arabia executives are experiencing the opposite. “Saudi Arabia’s strong digital infrastructure and efficient administrative systems mean that you can obtain many approvals within minutes rather than weeks. We simply do not see that level of coordination and speed elsewhere,” described Saudi Discovery Co.’s Al-Mutairi.

From the Ministry of Industry and Mineral Resources’ perspective, in seeking to accelerate the exploitation of the Kingdom’s US$2.5 trillion in reserves, it is a case of ‘the more, the merrier.’ Khalil Bin Salamah, vice minister of industrial affairs, offered his view: “I see the Ministry’s role as supporting both established and junior explorers through clear licensing, transparent bidding, and direct monetary incentives that encourage newcomers to enter the market.”

License to drill

For new entrants and investors in the Saudi market, a dual system of mineral licensing, via auctions and applications, is a key feature to become accustomed to. “Saudi Arabia uses a twin-track licensing system. Auction bid rounds target highly prospective areas, providing a transparent and relatively fast path to license awards, while a first-come, first-served process allows individual applications,” summarized MSA’s Benham.

In particular, given both its relative idiosyncrasy and its centrality to the licensing of the Kingdom’s most prospective ground, the bidding process is important to understand. It also brings with it important implications for company structure. Auctions are managed through the digital Ta’adeen platform, which requires companies to establish or partner with a local Saudi business entity. “Establishing a local entity is key for Ta’adeen access and compliance. The portal supports application management, license monitoring, and work-program submissions, with defined fee schedules and rules for exploration and mining licenses,” explained Christopher Schmidt, CEO of junior ANS Exploration.

Although some concede that the setup process for this can be complex, after access is granted the system has drawn praise. Tinka’s Carman highlighted: “The establishment of a local company and joint venture required a meticulous framework.”

Power Metallic’s Lynch confirmed that, once logged in, the Ministry’s bidding platform provides clear, efficient steps for mining licenses, adding: “Its transparency and responsiveness create a strong foundation for international explorers.”

Both companies won their licenses through the system, in its sixth and seventh rounds respectively.

“Saudi Arabia’s auctions are notably transparent, offering clear stages, standardized data rooms, and definitive calendars through the Ta’adeen platform. This clarity de-risks bid preparation and capital gating for explorers,” outlined ANS Exploration’s Schmidt.

It continues to be fine-tuned. “The bidding system is evolving rapidly, and the Ministry continues to refine it with each auction round. The Ministry actively listens to industry feedback, making the process increasingly transparent and efficient,” commended Batin Al-Ard’s Elhebery.

The last round of auctions to take place in 2025, the ninth, was the largest yet, offering over 25,000 km2 of concessions across three mineralized belts. “The licensing auction process for Round 9, which attracted 31 companies, including 25 international explorers, and is virtually unique worldwide in its ability to grant exploration rights so efficiently,” expressed Tim Keating, a portfolio manager at global mining financier Orion Resource Partners. Further details on auction rounds 1-10 are available in this report on pp. 36-37.

Roy Dabbous, regional manager for the Middle East at Hatch, looked ahead to the sector’s progression from exploration through to development: “The system is maturing and being actively tuned to enable delivery. Licenses have opened, JVs are forming with leading Saudi business groups, and feasibility work is underway.”

Image courtesy of Ivanhoe Electric

The Arabian-Nubian Shield has been shaped over 300 million years into a treasure trove of mineral wealth. Split by the Red Sea between the Arabian Peninsula and including parts of Egypt, Sudan, Eritrea and Ethiopia in north-east Africa, the Shield boasts an ancient, intricate polymetallic geology. In Saudi Arabia, beneath the surface across hundreds of thousands of square kilometers, lie in excess of US$2.5 trillion worth of the enormous geological complex’s mineral reserves. Much of that vast expanse of opportunity remains un- or underexplored, with potentially considerable minerals deposits concealed beneath sedimentary cover or within complicated tectonic zones.

It is this wealth of possibility that is a central driving force in the Kingdom’s emergence as one of the world’s fastest-growing mining markets. Between 2020 and 2024, exploration spending in Saudi Arabia quintupled, climbing from US$55 million to over US$280.5 million. “Exploration is currently the industry’s primary focus, positioning Saudi Arabia as a highly attractive destination. I would call it the ‘star’ of global mining,” lauded Yasir Hamid, division manager of mining and infrastructure solutions at Saudi equipment distributor Bin Shehab.

The diversity in Saudi Arabia’s mineral resources are part of what sets it apart as an exploration frontier. “Saudi Arabia is truly blessed with an abundance of mineral resources, including critical minerals and rare earth elements. Companies and investors are now focusing on minerals such as lithium, graphite, and rare earths in addition to the traditional gold, copper, and zinc,” explained Abdullah Al-Attas, general manager of service provider Geotech Arabia, also pursuing its own exploration projects.

Industry insiders are optimistic that this potential will soon bear fruit. “Much of Saudi Arabia’s highly prospective ground is already licensed and I am confident that major discoveries will be made across the Arabian Shield in future years,” said Antony Benham, regional director for the UK and Saudi Arabia at global mining consultancy MSA.

Untapped potential

One of the sector’s most important players in the Kingdom today is Arizona-based Ivanhoe Electric. “Our technology-driven platform targets some of the most prospective terrain globally, leveraging advanced tools and skilled personnel to generate discoveries that benefit both the Kingdom’s mining industry and our shareholders,” outlined Taylor Melvin, president and CEO.

In September 2025, Ivanhoe’s land package under exploration in a 50:50 joint venture with Maaden was expanded to over 50,000 km2. The vast scale on offer, as illustrated by Ivanhoe’s exploration footprint, is attracting international explorers to the Kingdom. “Activity on the Shield is accelerating, with major players exploring and early successes boosting the entire market,” observed Brock Salier, CEO of Almasar Minerals, which was awarded licenses in the ninth round of Saudi Arabia’s competitive auctions for exploration companies.

Another factor is the Kingdom’s predominantly greenfield status. “Saudi Arabia remains largely untapped, particularly for gold exploration, which is where we are focusing our effort. Early successes here could open doors to additional projects and partnerships,” said Graham Carman, CEO of Canada-headquartered junior Tinka Resources, which is exploring the Huwaymidan gold project in Saudi Arabia, in addition to its flagship Ayawilca project in Peru.

Geotechnical experts are optimistic about Saudi Arabia’s deeper geological formations too. “Areas under sedimentary cover and complex tectonic environments hold the potential for tier-one deposits,” suggested Teo Hage, VP technology for Xcalibur Smart Mapping, which is responsible for a 600,000 km2 regional geophysical mapping program across the Shield.

Modern technologies enable explorers to model deposits at depths of 500 m or deeper, with the Shield’s sparse surface exposure offering relatively simple ground setup and clean data. Of course, prospectivity is one thing, and results are another. While there is strong optimism, with the true potential only to become clear once drilling results are compiled.

At this still-early stage of Saudi Arabia’s mining development, those results will be a catalyst to help juniors, relying almost entirely on external capital, to generate investor interest. Mohammed Al-Mutairi, country manager at junior Saudi Discovery Co., reflected on current investor sentiments within the Kingdom: “Local investment remains challenging, because exploration is still a relatively new field for many Saudi investors. It takes time to build awareness of how this industry works and how value is generated over the long term.”

Opportunity in the intangibles

Saudi Arabia’s immense prospectivity is just one of many considerations juniors take when choosing one jurisdiction or another. Auxiliary factors, from funding environments to political culture, can influence explorers’ choices and appetite for risk. Those on the ground say the Kingdom is performing well. “Strong government support, good infrastructure, excellent local collaboration and a rapidly transforming cultural framework make for a positive and promising environment,” confirmed Tinka Resources’ Carman.

“The Kingdom’s updated mining regulations were a decisive factor in our entry, offering transparency, structure, and strong support for junior exploration companies,” verified Mohamed Elhebery, CEO and exploration manager for Batin Al-Ard, an Egyptian-Saudi joint venture gold and critical mineral explorer established in 2023.

Part of that support is a package of substantial financial incentives. Via its Exploration Enablement Program (EEP), the Saudi government is investing SAR 685 million (~US$182 million), offering funding of up to SAR 7.5 million (~US$2 million) per license to help cover early-stage exploration activity. Terry Lynch, CEO of Québec-based junior Power Metallic, exploring its Jabal Baudan concession in the Kingdom, applauded the program’s level of assistance: “Saudi Arabia’s exploration support program is one of the strongest globally. This forward-looking initiative helps de-risk early-stage exploration.”

Another factor marking out the Kingdom from many global peers is its stability. Saudi Arabia ranked in first place globally for political stability in the Fraser Institute’s 2024 survey; such are the benefits of absolute monarchy. This also applies to the security of on-the-ground operations. “Unlike elsewhere, where tenders often include armed guards and bulletproof vehicles, whereas in Saudi Arabia such measures are unnecessary. Local communities are welcoming, hospitable, and supportive,” explained Steve Little, CEO of market entry consultancy Massar Business Solutions.

Juniors also praise the Saudi government’s facilitation of rapid and agile activity. While in many other jurisdictions a common complaint from explorers is the time spent waiting for permits, in Saudi Arabia executives are experiencing the opposite. “Saudi Arabia’s strong digital infrastructure and efficient administrative systems mean that you can obtain many approvals within minutes rather than weeks. We simply do not see that level of coordination and speed elsewhere,” described Saudi Discovery Co.’s Al-Mutairi.

From the Ministry of Industry and Mineral Resources’ perspective, in seeking to accelerate the exploitation of the Kingdom’s US$2.5 trillion in reserves, it is a case of ‘the more, the merrier.’ Khalil Bin Salamah, vice minister of industrial affairs, offered his view: “I see the Ministry’s role as supporting both established and junior explorers through clear licensing, transparent bidding, and direct monetary incentives that encourage newcomers to enter the market.”

License to drill

For new entrants and investors in the Saudi market, a dual system of mineral licensing, via auctions and applications, is a key feature to become accustomed to. “Saudi Arabia uses a twin-track licensing system. Auction bid rounds target highly prospective areas, providing a transparent and relatively fast path to license awards, while a first-come, first-served process allows individual applications,” summarized MSA’s Benham.

In particular, given both its relative idiosyncrasy and its centrality to the licensing of the Kingdom’s most prospective ground, the bidding process is important to understand. It also brings with it important implications for company structure. Auctions are managed through the digital Ta’adeen platform, which requires companies to establish or partner with a local Saudi business entity. “Establishing a local entity is key for Ta’adeen access and compliance. The portal supports application management, license monitoring, and work-program submissions, with defined fee schedules and rules for exploration and mining licenses,” explained Christopher Schmidt, CEO of junior ANS Exploration.

Although some concede that the setup process for this can be complex, after access is granted the system has drawn praise. Tinka’s Carman highlighted: “The establishment of a local company and joint venture required a meticulous framework.”

Power Metallic’s Lynch confirmed that, once logged in, the Ministry’s bidding platform provides clear, efficient steps for mining licenses, adding: “Its transparency and responsiveness create a strong foundation for international explorers.”

Both companies won their licenses through the system, in its sixth and seventh rounds respectively.

“Saudi Arabia’s auctions are notably transparent, offering clear stages, standardized data rooms, and definitive calendars through the Ta’adeen platform. This clarity de-risks bid preparation and capital gating for explorers,” outlined ANS Exploration’s Schmidt.

It continues to be fine-tuned. “The bidding system is evolving rapidly, and the Ministry continues to refine it with each auction round. The Ministry actively listens to industry feedback, making the process increasingly transparent and efficient,” commended Batin Al-Ard’s Elhebery.

The last round of auctions to take place in 2025, the ninth, was the largest yet, offering over 25,000 km2 of concessions across three mineralized belts. “The licensing auction process for Round 9, which attracted 31 companies, including 25 international explorers, and is virtually unique worldwide in its ability to grant exploration rights so efficiently,” expressed Tim Keating, a portfolio manager at global mining financier Orion Resource Partners. Further details on auction rounds 1-10 are available in this report on pp. 36-37.

Roy Dabbous, regional manager for the Middle East at Hatch, looked ahead to the sector’s progression from exploration through to development: “The system is maturing and being actively tuned to enable delivery. Licenses have opened, JVs are forming with leading Saudi business groups, and feasibility work is underway.”